|

||

|

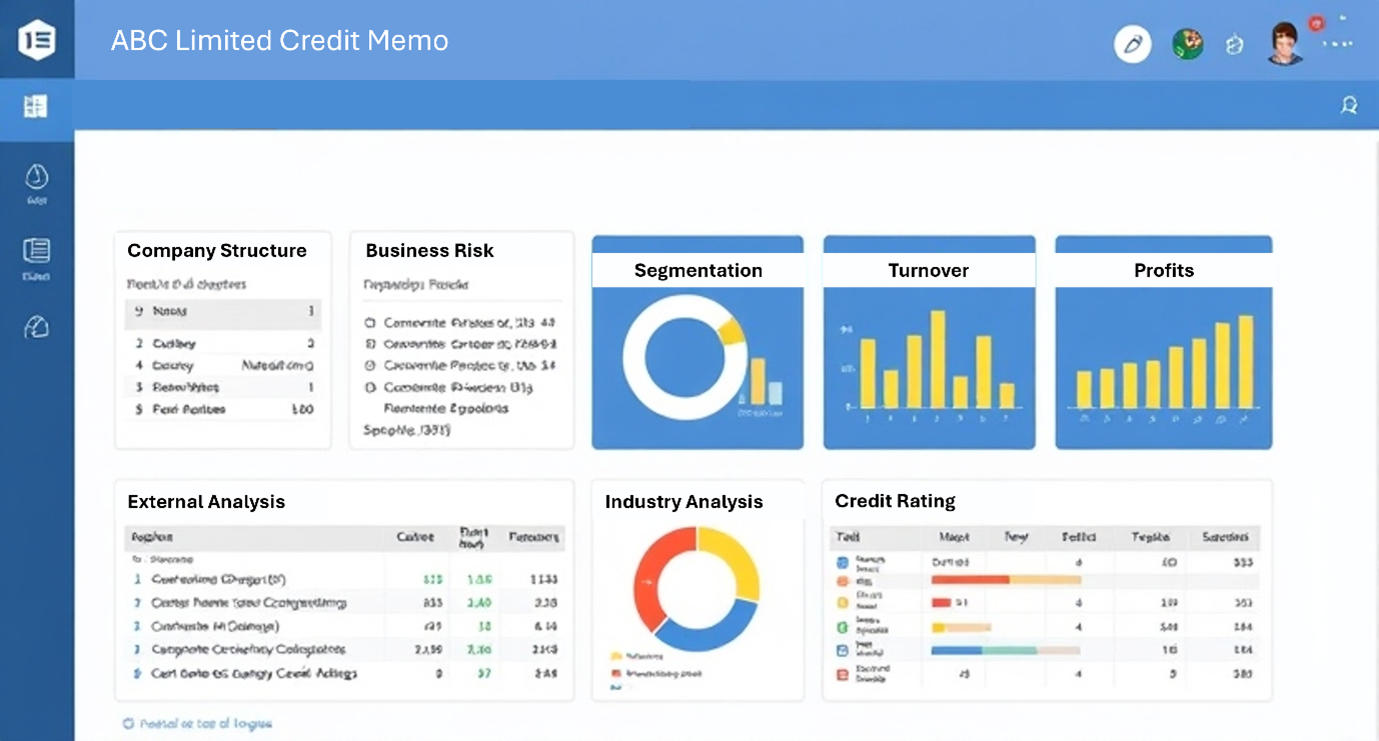

The automated credit memo is a cutting-edge, fully customizable platform designed to streamline credit assessment and early warning detection. It integrates data from multiple sources to deliver holistic borrower insights. The intuitive interface comprises pre-populated fields, editable AI-generated content, and comprehensive data inputs. Users can manage work-in-progress, save versions, and retrieve reports on demand, ensuring operational efficiency and data integrity. Key features of the platform are described below: |

|

Unified Borrower ProfilingThe platform aggregates data from proprietary, third-party, and auto-generated sources, creating cohesive borrower profiles that include their corporate structure, financial standing, risk metrics, and operational trends. It facilitates efficient due diligence and identifies potential opportunities for deeper engagement. |

Advanced AI-Driven AnalysisLeveraging generative AI, the platform produces nuanced, editable qualitative commentary, enabling users to enhance the analysis to meet specific requirements. This AI functionality extends to areas such as business descriptions, financial commentary, and projections, with flexibility for user input at each stage. |

|

|

In-Depth Financial EvaluationThe platform conducts comprehensive financial analysis, covering balance sheets, P&L, DuPont metrics, and borrowing patterns. Users gain visibility into key performance indicators, stress points, and statutory compliance, making it an indispensable tool for assessing the financial health and creditworthiness of an entity. |

Dynamic Decision Support & ReportingUsers can generate detailed reports and credit memos tailored to their specifications. The system’s decisioning capabilities include features such as SWOT analysis, legal case summaries, and analyst recommendations, all of which contribute to a more informed and defensible decision-making process. |

|